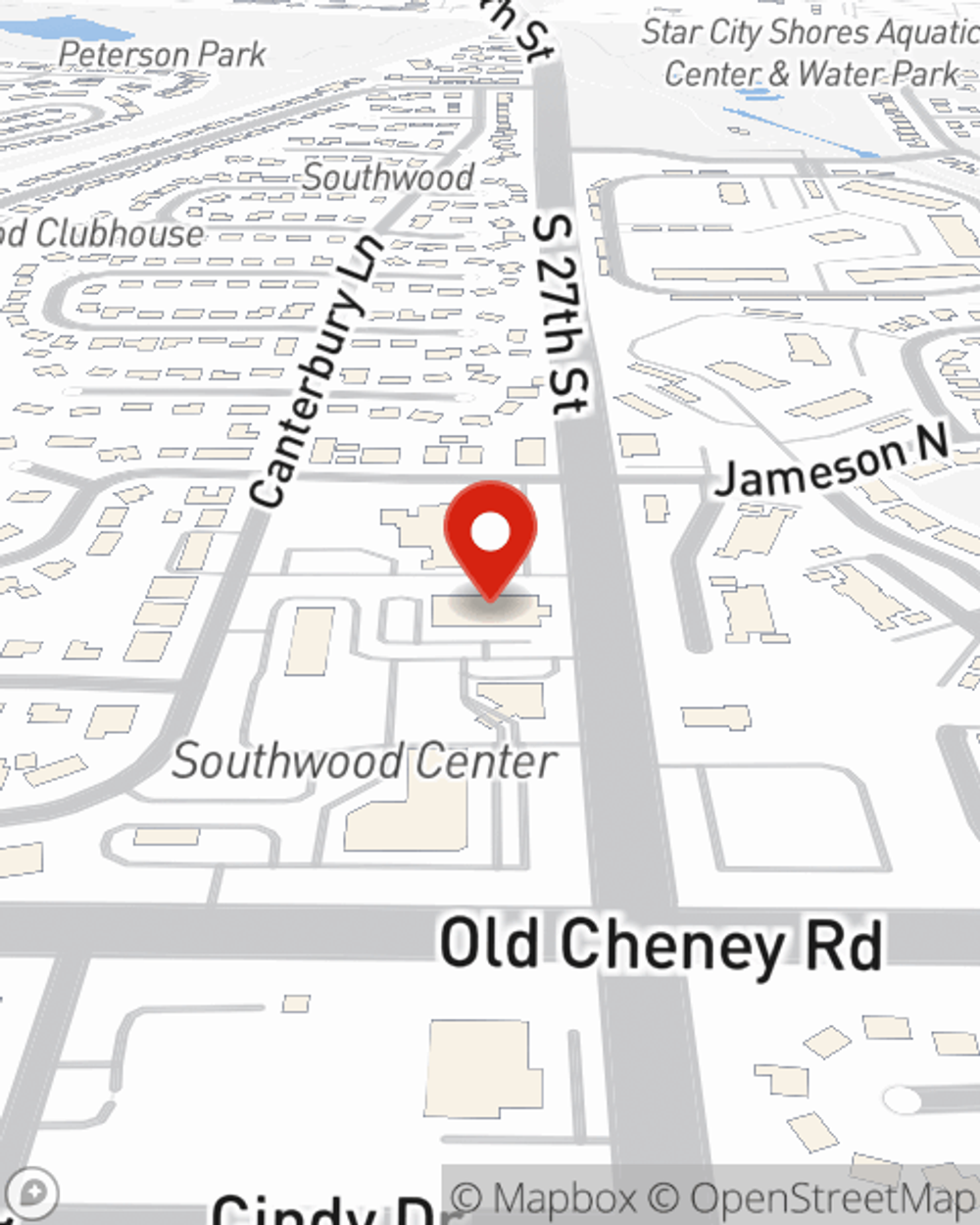

Business Insurance in and around Lincoln

Calling all small business owners of Lincoln!

Helping insure businesses can be the neighborly thing to do

- Lincoln

- Hickman

- Denton

- Lancaster

- 68512

- 68516

- 68526

- Roca

- South Lincoln

- Waverly

- Eagle

- Malcolm

- Seward

- Beatrice

- Crete

- Syracuse

- 68502

- Saline

- Gage

- Country Club

Cost Effective Insurance For Your Business.

Operating your small business takes effort, commitment, and great insurance. That's why State Farm offers coverage options like errors and omissions liability, a surety or fidelity bond, extra liability coverage, and more!

Calling all small business owners of Lincoln!

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Paul Johnson for a policy that covers your business. Your coverage can include everything from extra liability coverage or worker's compensation for your employees to employment practices liability insurance or key employee insurance.

Reach out agent Paul Johnson to discuss your small business coverage options today.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Paul Johnson

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.